snohomish property tax payment

Precisely how much you have to pay will vary depending on where you live and the value of. To pay by telephone call toll-free 18884730835.

Snohomish County Property Tax Payments Annual Snohomish County Washington.

. Tax Payment Options Snohomish County WA - Official Website hot snohomishcountywagov. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. If your taxes are still delinquent on June 1st you are subject to a 3 penalty.

Is the service provider for the Snohomish County EBPP Electronic Bill Presentment. Snohomish County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Snohomish County Washington. Pennington Property Snohomish County.

Point Pay Support. Email the Treasurers Office with your parcel information and the new address information. Please call 425-388-3606 if you would like to make payments on your DELINQUENT property Taxes.

If youre a homeowner youll have to pay property taxes each year. Each creditdebit card transaction is limited to 9999999 including a service fee of 222 percent of the transaction amount minimum 1. Interest continues to accrue until the taxes are paid in full.

The remaining approximately 80 goes to other taxing jurisdictions such as the Northshore School District the County and the State. These records can include Snohomish County property tax assessments and assessment challenges appraisals and income taxes. Payment account to collect and disburse taxes biannually to Snohomish County AssessorTreasurer hereinafter referred to as County on behalf of the below named parties.

Median Property Taxes No Mortgage 3534. Your Secured Property Tax Bill contains your Assessors Identification Number AIN Year and Sequence which you will need to complete the transaction. The following links maybe helpful.

View your online tax statement. Click for Instructions. Fill out the form on the back of your tax statement and mail it with your payment in the envelope provided.

Point and Pay charges. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Tax Statements are Mailed to the Property Taxpayer of Record.

Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office. Offered by County of Snohomish Washington. With an average tax rate of 089 Snohomish County residents pay an average of 3009 a year in property taxes.

Snohomish County argues that its property taxes should be granted first priority because. Fetch Document CITY OF SNOHOMISHCITY OF SNOHOMISH Founded 1859 Incorporated 1890 116 UNION AVENUE SNOHOMISH WASHINGTON 98290 TEL æ. 1 the order approving the boat property sale authorized payment.

Median Property Taxes Mortgage 3638. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. In case you missed it the link opens in a new tab of your browser.

If you pay the first half of your taxes by April 30th but fail to pay the second half by October 31st the unpaid portion is subject to 1 interest per month. Make a one time payment below using your Parcel ID OR use the Create an account link to make future payments easier. Snohomish County collects on average 089 of a propertys assessed fair market value as property tax.

Pay for services online. New Functionality for 2016- SEE YOUR TAX STATEMENT ONLINE. During the months of April and October you will pay your taxes by cash check money order debit or credit card at the Snohomish County Administration East buildings front door.

Pay the county now. The City of Bothell portion of the property tax includes four components. The voter approved Streets and.

Use the search tool above to locate your property summary or pay your taxes online. During the months of April and October you will drop tax payments in the secure drop box. Sign up for PAPERLESS BILLING for future tax statements.

Please take a moment to view or convenient tax payment options. For more information please visit the web pages of Snohomish Countys Assessor and Treasurer or look up. Make one time payments eCheck or credit card.

425-262-2469 Personal Property. Snohomish County Treasurer Payments. 2006 June Layout -final ColorAuditor 425-388-3444 wwwcosnohomishwaus Property Taxes Snohomish County Assessors Office 425-388-3433 wwwcosnohomishwaus Mukilteo City Views Summer 2006.

WA GOLD BAR REPORTER Property Tax Bothell WA The Property Tax Annual Cycle MyTicor. The Property Tax Annual Cycle in Washington State MyTicor COVID 19 Response and Resources Snohomish County 06022021 Tax Payment Options Snohomish County Terminated Snohomish County Director John E. Monthly Collection Services Snohomish County Property Taxes 012319 Snohomish County Property Tax Payment Program Fee Schedule Account Setup Fee 7500 Monthly Account Processing Fee 1500 Phone Payment Fee 2000 NSF Fee 3500 Early Termination Fee 3500.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. The Assessor and the Treasurer use the same software to record the value and the taxes due. 2022 Point Pay.

The City of Bothell receives approximately twenty percent of the property taxes paid on properties located in Bothell.

About Efile Snohomish County Wa Official Website

Pin By The Platz Group On Homes For Sale In Snohomish County Marble Tile Floor Corner Fireplace Outdoor Decor

How To Read Your Property Tax Statement Snohomish County Wa Official Website

News Flash Snohomish County Wa Civicengage

Snohomish County Camano Association Of Realtors Linkedin

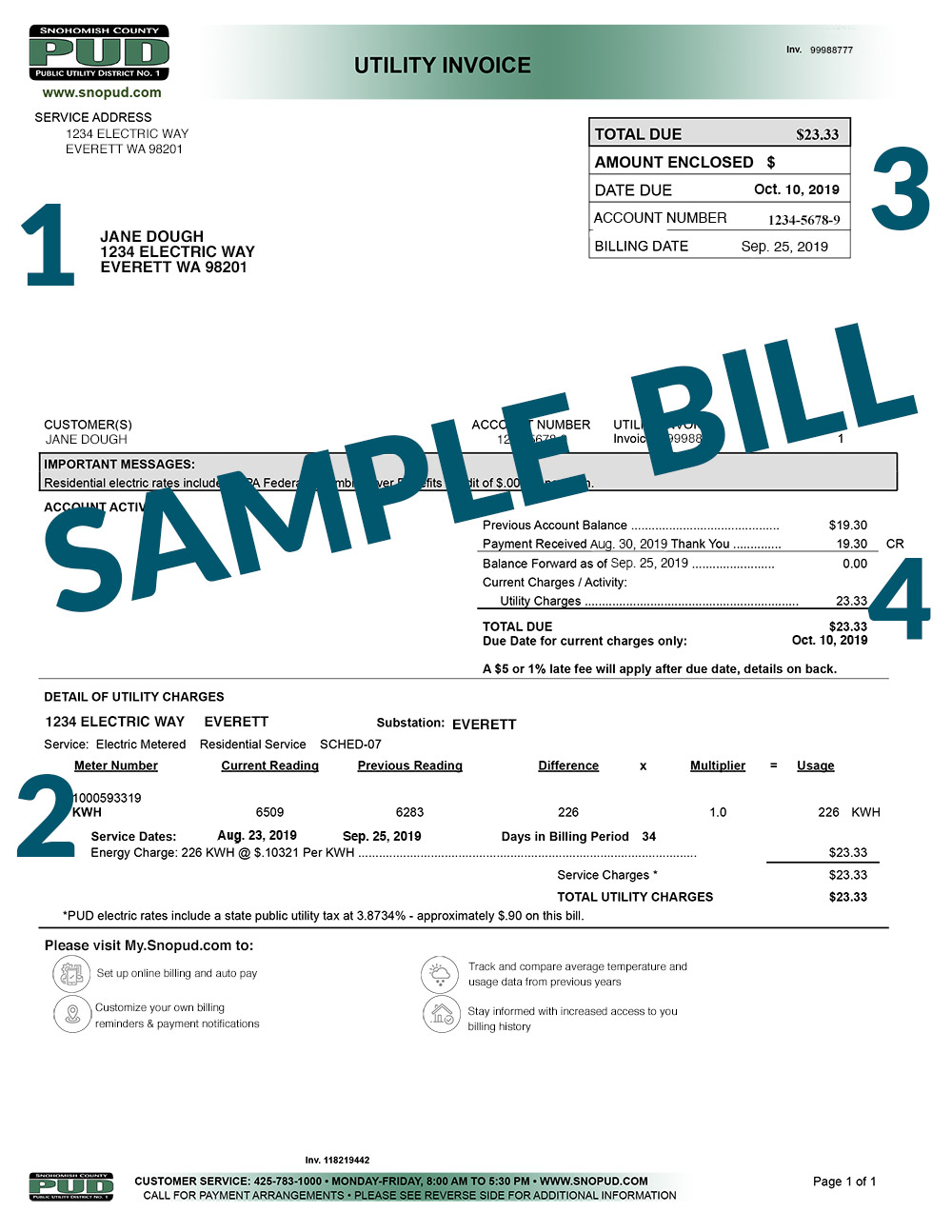

My Billing Statement Snohomish County Pud

Snohomish County Property Tax Exemptions Everett Helplink

Snohomish County Treasurer Payments

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

No Increase In Property Taxes From Snohomish County News Goskagit Com

Snohomish Conservation District Facebook

How To Read Your Property Tax Statement Snohomish County Wa Official Website

The Cozy Pyramid House That Ll Make You Move To Snohomish Pyramid House Pyramids House

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com